Tick data can also be used as leading indicators for short-term price movements. For example, large-volume trades may represent institutional investors, while small-volume trades may indicate retail-trading activity. Analyzing tick data may provide insights into trading behaviors that are usually not shown in a price chart. When tick data is incorporated into backtesting a strategy, it can realistically simulate market participants' buying and selling activities. Crypto futures tick data contains various useful information about each trade and the crypto futures market as a whole. Hence, transactions that occurred in a fraction of a second would be recorded and aggregated for analysis. This means tick data displays each trade as it happens. In crypto markets, professional traders use crypto futures tick data to analyze trading activity at its most detailed level. Tick data refers to market data that shows the price and volume of every print. Historical data is divided into two types: Tick data and Order-book data. Historical data - Historical data is a critical component of backtesting, which can be used to simulate varying market conditions at different points in time. On the other hand, some software is paid but offers comprehensive and advanced features to support complex trading strategies. Some software is free to use but with limited capacity for backtesting. This enables you to compare one backtested strategy with another.īacktesting software - There is plenty of backtesting software available on the internet. maximum drawdown, win/loss ratios, Sharpe ratio, etc. Benchmark performance - Results from backtests should be assessed based on key performance metrics such as maximum profit vs. Therefore, you must familiarize yourself with the native programming languages that are used on each platform.Ĥ. Most backtesting platforms require users to have a basic knowledge of programming to code a backtest. Choose a platform that supports the markets you want to trade in and study the sources of market data it supports. Backtesting platform - Many platforms provide the functionality to perform backtesting on historical data. As such, traders need to assess trading strategies under various market conditions to understand how they perform.ģ. For instance, a backtest during the dramatic crash in March would yield different results to a backtest in a bull market today.

This means market movements can be unpredictable and will not always behave in the same way. Historical data covering different market conditions - Market factors and major announcements often dictate the price of cryptocurrencies, including protocol upgrades, strategic partnerships, and even macroeconomic trends. Therefore, you must ensure that your strategy's parameters match the crypto asset's underlying characteristics.Ģ. Two assets with varying degrees of volatility will produce different backtest results.

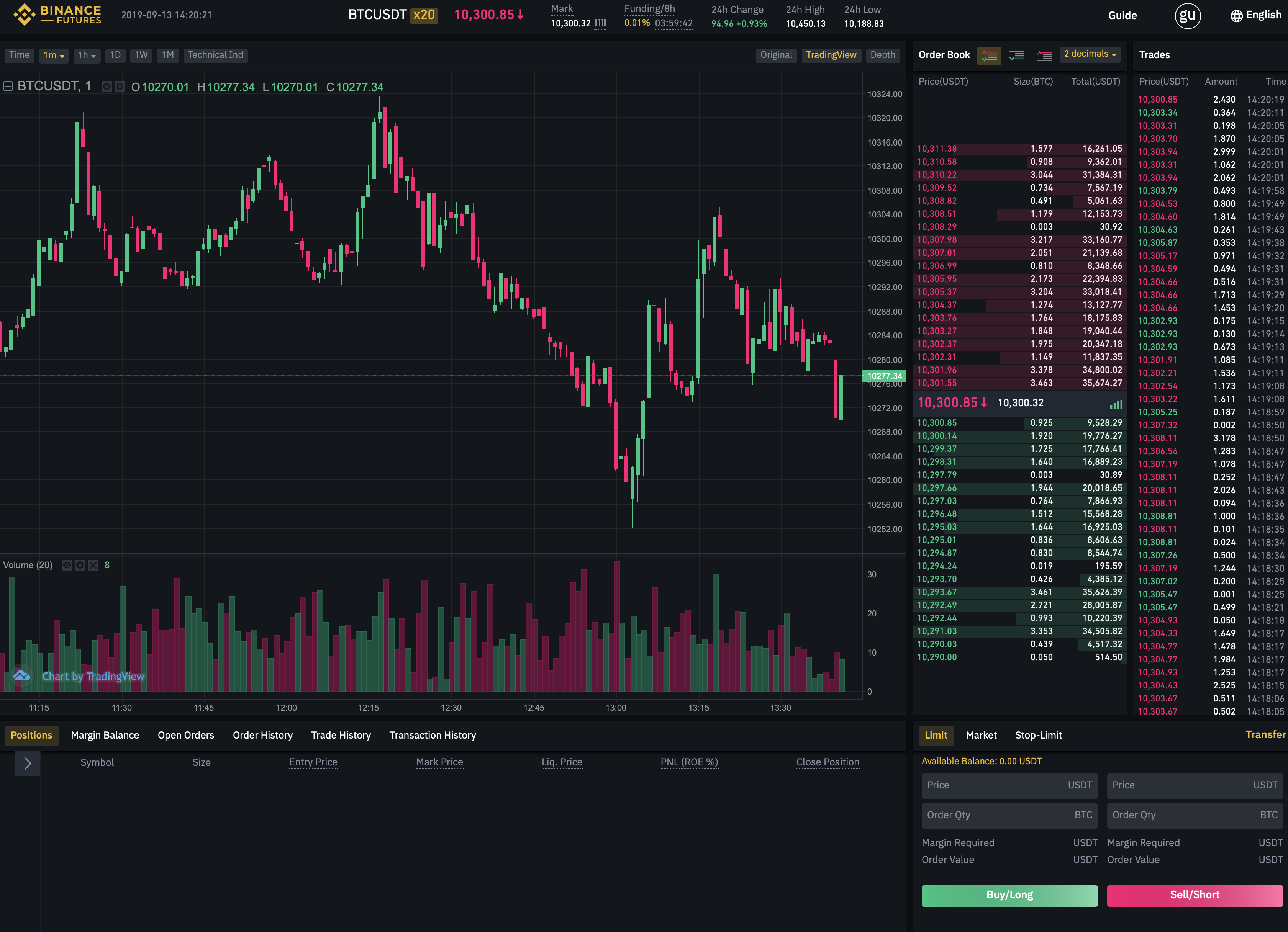

Certain crypto assets experience higher volatility than others but can produce higher returns and vice versa. Picking the right futures market - Binance offers a vast selection of crypto futures contracts, each with varying characteristics. Thus, traders should ensure that their backtesting software accounts for these costs.Ĥ Essentials of Backtesting in Crypto Futures Marketsġ. These can add up throughout the backtesting period and have a significant impact on a strategy's performance. A backtest should also consider all trading costs, however insignificant. While the market never moves precisely the same, backtesting relies on the assumption that markets move in similar patterns as they did historically.Ī successful backtest is typically evaluated for two key objectives: overall profitability and the amount of risk taken. If a backtest shows promising results, traders may have the confidence to deploy the tested strategy in real-time. Traders use backtesting as a means of evaluating and comparing different trading strategies without risking capital. The backtest would assess which lengths of moving averages produce the best results based on Bitcoin's historical performance. To do so, you would need to gather Bitcoin's historical data and test the strategy's parameters. Suppose you want to backtest how a simple moving average crossover strategy would perform on Bitcoin. Simply put, backtesting is a process of evaluating a trading strategy based on historical prices. Ultimately, you want to know whether it is worth your money. And finally, test drive to see if the vehicle is a good fit for you. Before buying a car, you would consider factors such as the history of the brand, safety features, and etc.

0 kommentar(er)

0 kommentar(er)